A few common expenses that are not included in operating expenses are income taxes, property depreciation or any fees that occurred through financing. Some examples of common operating expenses are property taxes, insurance on the property, and maintenance utilities not paid by tenants.

Operating expenses are only the expenses needed to operate the property. that would add to the income of the property. This will get more complicated depending on if there are parking fees, onsite laundry, etc. In easier terms, if you have a basic rental property, like a 4 plex, the gross income would be the complete rent amount minus the cost of any empty units. Gross income refers to all of the income generated by the property minus the cost of goods sold. You wouldn’t include the payment of the new company vehicle, even though it is a business expense it is not tied directly to the building. Specifically, This would include anything necessary to keep the property functioning as usual.

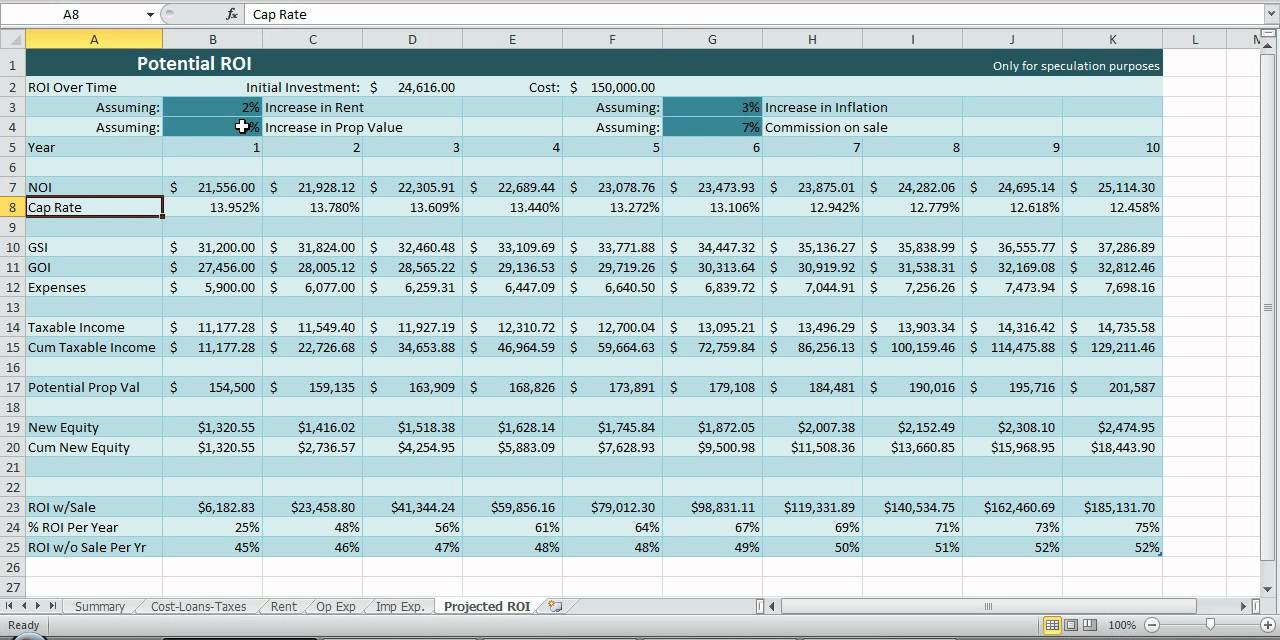

To calculate the net operating income they would take the gross income of the business and subtract the corresponding expenses property fees, insurance, building upkeep, and utilities. In other words, the formula shows the cash flow a property has after subtracting all reasonable expenses.Īs a brief example of this, if a business owner is experiencing growth and makes the decision to expand into a larger location.

Net operating income (NOI) is a term often used in real estate accounting that refers to the formula for the profitability of a commercial property.

0 kommentar(er)

0 kommentar(er)